The Merge: Longer-term implications for blockchain and cryptocurrency markets

The Merge is on track for tomorrow. The Ethereum Mainnet (“Ethereum” as we know it today) will join with the Beacon Chain (see here for details). This means:

1. Ethereum will transition from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism.

2. The rate of issuance of ether (ETH), Ethereum’s native cryptocurrency, will decrease.

3. Ethereum’s energy consumption will decrease.

Launched in 2015, Ethereum is the world’s first-ever blockchain that enables smart contract applications and the world’s second-ever blockchain (the first was Bitcoin, launched in 2009). Blockchain is a digital record-keeping system that aims to make data immutable – difficult to modify or delete once recorded (blockchain technology explained here). Today, Ethereum is widely adopted and used for diverse use cases, from representing and transferring ownership of digital assets such as ETH and non-fungible tokens (NFTs) to deploying smart contracts[i], including Decentralized Autonomous Organizations.

The Merge is arguably the biggest change made to any blockchain to date and brings important implications for blockchain and cryptocurrency markets.

Figure 1: The Merge and Implications

1. Ethereum is transitioning from a Proof-of-Work to a Proof-of-Stake consensus mechanism

Explanation:

“Consensus mechanism” refers to the decision-making process that governs what information gets officially recorded on a blockchain. In blockchain technology, a “node” is a computer that runs a blockchain protocol. Nodes verify and add information to the blockchain by creating “blocks,” organizational units of official records.

The primary difference between PoW and PoS consensus mechanisms lies in who – people running nodes – gets to add new blocks.

PoW: The terms “miners” are specific to the PoW consensus mechanism. Miners are a subset of nodes that compete against one another by solving for computational puzzles to add new blocks. Mining refers to the work and process of adding new blocks using PoW. The likelihood of successfully mining a new block depends on computing power. The more computing power, the higher the likelihood of creating and adding a new block.

PoS: The term “validator” is specific to the PoS consensus mechanism and denotes a subset of nodes selected in a lottery-based system to add new blocks. The likelihood of being chosen to add a new block depends on the amount of ether (ETH) staked. The more ETH staked, the higher the likelihood of being chosen to add new blocks.

Implications:

The transition from a PoW to PoS consensus mechanism will test Ethereum’s ability to overcome the Blockchain Trilemma.

The Merge is a part of a larger Ethereum vision that aspires to overcome the Blockchain Trilemma. The Blockchain Trilemma refers to the generally accepted view that any given blockchain can achieve only up to two out of three objectives: decentralization, security, and scalability. The ultimate test for Ethereum post-merge is whether it can achieve all three objectives.

Decentralization refers to distributed decision-making across many individuals. It stands in contrast to centralization, which puts decision-making control in the hands of a few actors. The more independent nodes that can participate in deciding what information gets added to a blockchain, the more decentralized a blockchain is.

Security refers to the validity of the information that gets recorded on a blockchain and the ability to keep the valid set of records from being altered.

Scalability refers to the ability of a blockchain to process more transactions faster and grow its network.

Figure 2: The Blockchain Trilemma test for Ethereum

The Decentralization test: Can Ethereum’s staking pool distribution become more diversified?

Today there is heated debate about whether PoW or PoS can provide greater decentralization. There is disagreement on which consensus mechanism makes it easier for more independent nodes to participate in adding new blocks. Some argue that there is a lower barrier to entry to run a node on the PoS-based Ethereum - minimum requirements are access to an average laptop and 32 ETH (equivalent to ~ $51,000 USD at the time of writing). In contrast, running a node on the PoW-based Ethereum requires acquiring more specialized and expensive hardware such as Graphics Processing Units (GPUs) or Application-Specific Integrated Circuits (ASICs).

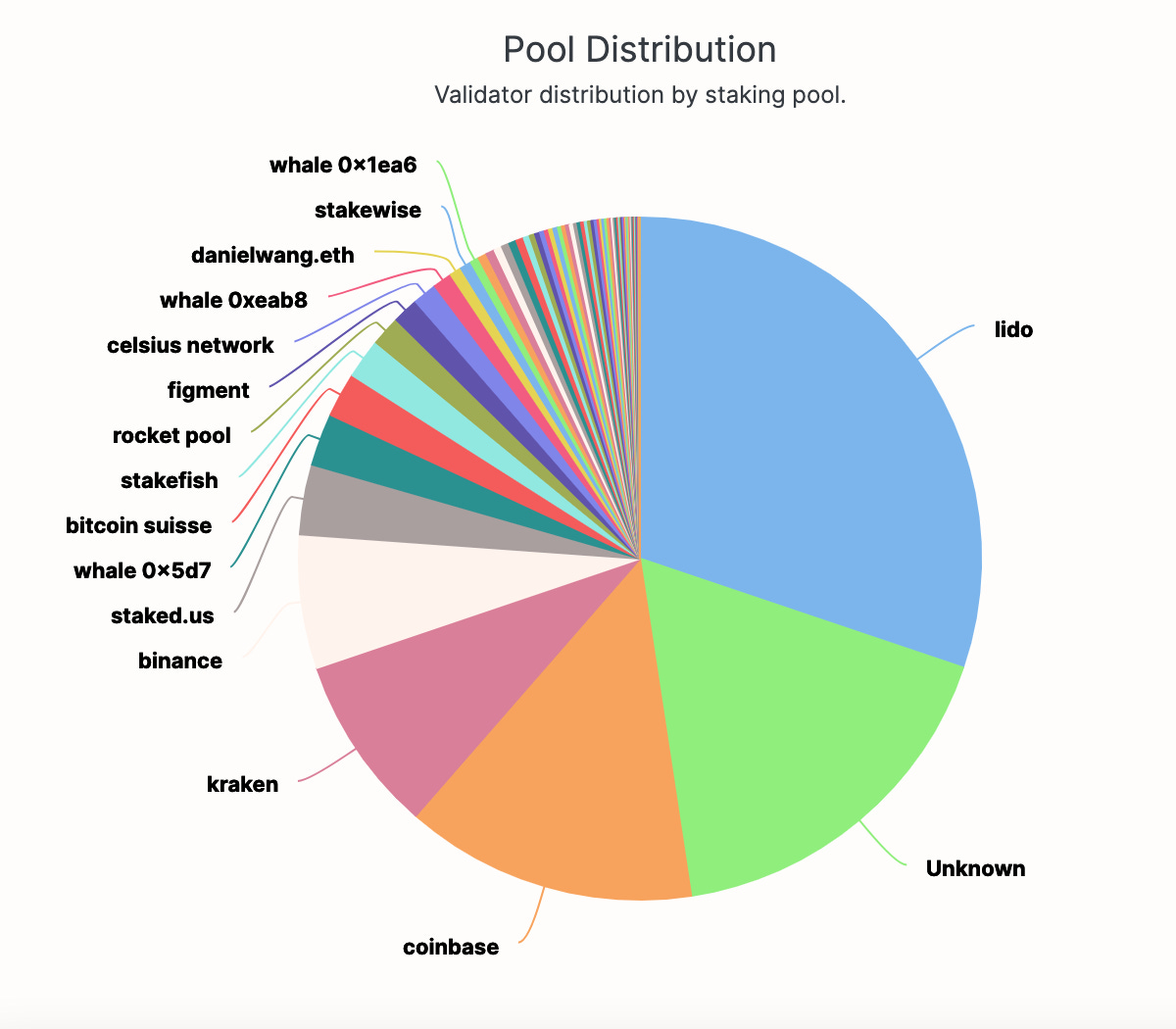

However, a lower barrier to entry on PoS-based Ethereum does not necessarily mean more decentralization. The PoS consensus mechanism is effectively a lottery system to select which validators can create new blocks. The more ETH staked, the greater the likelihood of being selected. This has led to the rise of ETH staking pools, where individual validators aggregate their ETH and work together as a single group to increase the chance of being selected. At the time of writing, staking pools run by Lido (~30%), Coinbase (~14%), Kraken (~8%), and Binance (~6%) make up almost 60% of the entire ETH staked on the Ethereum PoS blockchain. At least initially post-merge, the decision-making process for adding new blocks to Ethereum post-merge will arguably be more centralized than decentralized. The level of centralization vs. decentralization in the longer term will depend on whether more independent staking pools emerge and to what degree they can diversify the staking pool distribution.

Source: https://beaconcha.in/pools

The Security test: How well will Ethereum post-merge withstand attacks compared to pre-merge?

Depending on the consensus mechanism, adding new blocks - the act of creating official records - is more or less difficult. Typically, adding new blocks is intentionally made difficult for security reasons. The more difficult it is to do, the more difficult it is to undo. To change official records on PoW-based Ethereum, an attacker needed to amass 51% of the computing power on the network. To change official records on PoS-based Ethereum, an attacker now needs to amass 51% of ETH staked by validators.

Some argue that PoS is less secure than PoW as it is easier for attackers to amass the majority of staked ETH than the majority of computing power necessary to overpower a blockchain network. The lower barrier to entry to become a validator on PoS-based Ethereum – a laptop and 32 ETH as opposed to GPUs or ASICs – applies to both honest and malicious validators alike. Conversely, others argue that there is less incentive for validators to attack the Ethereum blockchain running on PoS because there will be additional penalties for attackers, such as losing all of their staked ether (also known as “slashing”).

Both Bitcoin, which uses PoW, and PoW-based Ethereum have been generally considered as among the most secure blockchains that have withstood the test of attempted attacks over time. The security of PoS-based Ethereum remains to be tested post-merge and will help inform the ongoing PoW vs. PoS debates.

The Scalability test: Will Ethereum’s future upgrades successfully reduce transaction processing times and fees?

The Merge sets the stage for future upgrades, including those that intend to enhance Ethereum’s scalability in the coming years (e.g., reduce transaction processing times and fees on the Ethereum blockchain). The Merge itself will not enhance Ethereum’s scalability but lays the foundations for future upgrades to do so. The test for PoS Ethereum’s scalability will play out in the coming years.

2. The rate of issuance of new ether (ETH), Ethereum’s native cryptocurrency, will decrease

Explanation:

There are two ways the total amount of ETH in circulation can change:

Increase, by rewarding miners (in PoW) and validators (in PoS) for their work in creating new blocks

Decrease, by burning (destroying) a portion of the fees that users must pay in ETH to transact on Ethereum

In PoW-based Ethereum, mining rewards issued ~13,000 new ETH/day. In PoS-based Ethereum, staking rewards will issue ~1,600 new ETH/day. In parallel, at least ~1,600 ETH will continue to be destroyed as part of burned transaction fees. Effectively, the rate of new ETH issued will decrease by ~90%, and make net ETH inflation close to zero. ETH may even become deflationary depending on the number of transactions that are processed (more transactions will mean more ETH in transaction fees burned).

Implications:

ETH’s inflationary rate will decrease, but the longer-term value of ETH will depend on the overall security of Ethereum.

If the demand for ETH is assumed equal, the reduction in the supply of ETH will increase the value of ETH. ETH is currently the largest smart contract token by market capitalization and the second largest cryptocurrency by market capitalization, at approximately half that of BTC. There is much speculation about the potential for ETH to become the dominant cryptocurrency, overtaking BTC. In the immediate aftermath of the Merge, there will likely be significant price volatility and ETH trading action from both bearish and bullish ETH speculators.

In the longer term, the ability of PoS to ensure the security of ETH transactions on Ethereum will directly impact the potential of ETH to compete against BTC as the dominant cryptocurrency. There are numerous examples of 51% attacks that have successfully reorganized blockchain transaction history, leading to stolen funds. If Ethereum post-merge suffers from attacks that lead to the perception it is not secure, its native cryptocurrency ETH will also suffer.

3. Ethereum’s energy consumption will decrease

Explanation:

The Ethereum Foundation estimates that transitioning to PoS will reduce Ethereum's energy consumption by ~99.95%. In PoW, miners are more likely to be selected to create blocks the more computing power they have, using energy. In PoS, validators are more likely to be selected to create blocks the more ETH they stake, which is not energy-dependent.

Implications:

Institutional adoption of Ethereum will likely increase but will depend on the overall security and scalability of Ethereum post-merge.

There has been much controversy surrounding the energy consumption of PoW-based blockchains. Environmental, Social, and Governance (ESG) topics have increasingly been a priority agenda for regulatory bodies and corporations.

Today many institutions including Fortune 500 companies already use Ethereum to build enterprise blockchain applications and private blockchains leveraging Ethereum technology. Ethereum’s transition to PoS will likely lead to greater institutional adoption of Ethereum as its reduced energy consumption means greater alignment with the ESG agenda. Increased adoption would likely further bolster Ethereum’s market position as a blockchain and ETH’s market position as a cryptocurrency. Institutional adoption of Ethereum generally corresponds to more private, centralized applications of blockchain. Ethereum’s ability to provide security and scalability, which will be tested post-merge, will likely impact the longer-term institutional adoption of Ethereum.

The Merge will bring important lessons for years to come

Blockchains typically do not change their consensus mechanisms; changing the rules by which a blockchain keeps official records is a significant decision and undertaking. The Merge has been discussed and planned for many years by the Ethereum community.

The significant changes the Merge will bring to Ethereum will help inform blockchain and cryptocurrency markets in the longer term. Whether and how Ethereum post-merge withstands the decentralization, security, and scalability tests will provide important lessons learned for all blockchains, impact the longer-term value of ETH, and shape the future adoption of Ethereum.

[i] Smart contracts are collections of code that outline the terms and conditions of an agreement and can automatically execute specific functions when these predefined terms and conditions are met.

This article was prepared by Jaymin Kim in her personal capacity. The views and opinions expressed in this article are those of the author and do not necessarily represent the views and opinions of Marsh McLennan.

About the Author: Jaymin Kim is a Director at Marsh McLennan and drives global commercial strategy with a focus on cyber, technology, and digital. In her role, Jaymin explores longer-term commercial opportunities in the areas of risk, strategy, and people.